When it comes to big, powerful investment themes, it’s hard to look past the growth of e-commerce.

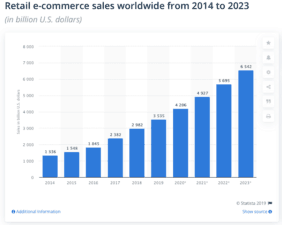

Today, over 1.8bn people worldwide e-shop with sales amounting to around $3.5trn. Yet with more and more people accessing the internet, and advances in technology making it easier to shop online, analysts are expecting global retail online sales to soar to a staggering $6.5trn by 2023.

Should you invest £1,000 in Advanced Medical Solutions Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Advanced Medical Solutions Group Plc made the list?

Source: Statista

For investors, the growth of e-commerce is generating plenty of opportunities. With that in mind, here are three of my top UK e-commerce stocks to buy for 2020 and beyond.

ASOS

One e-commerce stock I’m quite bullish on is online fashion retailer ASOS (LSE: ASC). Its website asos.com offers a fantastic range of clothes as well as a seamless shopping experience for consumers. Over the last three years, revenue has climbed from £1.4bn to £2.7bn.

What I like about ASOS is that the company appears to have significant potential for international growth, particularly in the US. While UK sales came to nearly £1bn last year, US sales were just £341m. This leads me to believe that group sales could climb much higher in the years ahead as the company expands internationally. “We are well-positioned to take advantage of the global growth opportunity ahead of us,” said CEO Nick Beighton in the group’s most recent full-year results.

I’ll point out that ASOS shares rarely trade cheaply. Currently, the forward-looking P/E ratio is a high 57 (falling to 37 using the FY2021 EPS forecast). Personally, I’m ok with that valuation given the growth potential here, but be aware that it doesn’t leave a huge margin of safety.

Boohoo

Another online clothing retailer that I’m excited about is Boohoo (LSE: BOO). It owns the brands Boohoo, Pretty Little Thing, Nasty Gal, MissPap, Karen Millen, and Coast. Over the last three years, sales have climbed from £195m to £857m and looking ahead, the group is aiming to deliver revenue growth of 25% per year in the medium term.

Boohoo also appears to have strong growth prospects internationally. Helped by the group’s strong social media presence, international revenue has exploded higher in recent years. “We are well-positioned to disrupt, gain market share, and capitalise on what is a truly global opportunity,” said CEO John Lyttle earlier this year.

Like ASOS shares, Boohoo shares are not cheap. Currently, the forward-looking P/E is 58 (falling to 46 using the following year’s earnings estimate). That’s an expensive price tag, however, given the prolific growth here, I don’t think it’s that unreasonable.

Tritax Big Box

Finally, check out Tritax Big Box (LSE: BBOX). It’s a real estate company that owns a portfolio of strategically-located warehouses that are let out to retailers such as Amazon and Argos.

The reason I like BBOX as an e-commerce play is that the shift to online shopping is creating a very strong demand for warehouse space in the UK. Indeed, according to a recent report from property consultancy Lambert Smith Hampton, we are currently seeing “unprecedented demand for strategically-located logistics warehouse space across many parts of the country.” This is a good sign for companies that operate in this niche area as it means they can keep raising rents.

Tritax shares currently trade on a forward-looking P/E ratio of 22 and offer a prospective dividend yield of 4.7%. At those metrics, I think the stock offers considerable value.